Ultimate week Nvidia launched its quarterly profits to a lot fanfare (together with this Nvidia profits watch birthday celebration in NYC). Alternatively, in spite of beating Wall Boulevard’s expectancies all over again, the inventory declined up to 5% in after-hours buying and selling.

For some context, Nvidia turned into the second most dear corporate on this planet (at ~$3 trillion) on account of the AI revolution. Following the discharge of ChatGPT in November 2022, the call for for AI/LLMs (massive language fashions) exploded. This supposed extra information facilities and extra computing energy.

The spine of all of this extra compute comes from GPUs (graphical processing devices). That’s what Nvidia produces and it produces them higher than any person else. Because of this, the call for for his or her GPUs went in the course of the roof.

Lately, most of the biggest tech corporations are spending a large portion in their overall capital expenditures on Nvidia’s GPUs. For instance, Microsoft spends just about 40 % in their overall capital expenditures on Nvidia, up from lower than 10% a few 12 months in the past. You’ll see simply what quantity of money most of the tech giants are sending to Nvidia in this chart from Yahoo Finance:

This explains why Nvidia has 80% to 95% marketplace proportion in AI computing.

But it surely’s now not simply their overall marketplace proportion that issues, however their expansion. As this chart from Yahoo Finance illustrates, Nvidia’s information middle income is up 6x over the prior 5 quarters:

While you mix this fantastic expansion in income with their close to monopoly on GPUs, you get a inventory this is up 150% YTD.

However as spectacular as Nvidia’s expansion has been, I’m right here to let you know that its valuation is out of keep an eye on.

To offer some context for this remark, let’s take a look at the Worth-to-Gross sales (P/S) ratio of Nvidia lately when put next with Microsoft’s P/S ratio all the way through the DotCom bubble. I’ve aligned those two measures such that the height of every P/S ratio happens on the identical time (i.e. on the 2,five hundredth buying and selling day) within the chart beneath:

Nvidia is buying and selling at the next P/S more than one lately than Microsoft was once all the way through the height of the DotCom bubble!

And have you learnt what took place to Microsoft after its P/S ratio peaked? Its inventory were given reduce in part and didn’t totally get well for 14.5 years.

From January 2000 to July 2014, Microsoft returned 0% whilst the S&P 500 went up 77% on a complete go back foundation:

In fact, I’m really not implying that the similar precise factor will occur to Nvidia, however you’ll be able to see why it’s regarding.

I most often don’t like depending on valuation metrics, alternatively, the P/S ratio is one I track within the extremes. The explanation why is as it’s the purest valuation metric available in the market. You’ll’t manipulate it with accounting tips like you’ll be able to profits (P/E) or e book price (P/B). Out of doors of outright fraud, gross sales are tough to faux. Because of this, this metric may also be somewhat dependable all the way through frothy sessions.

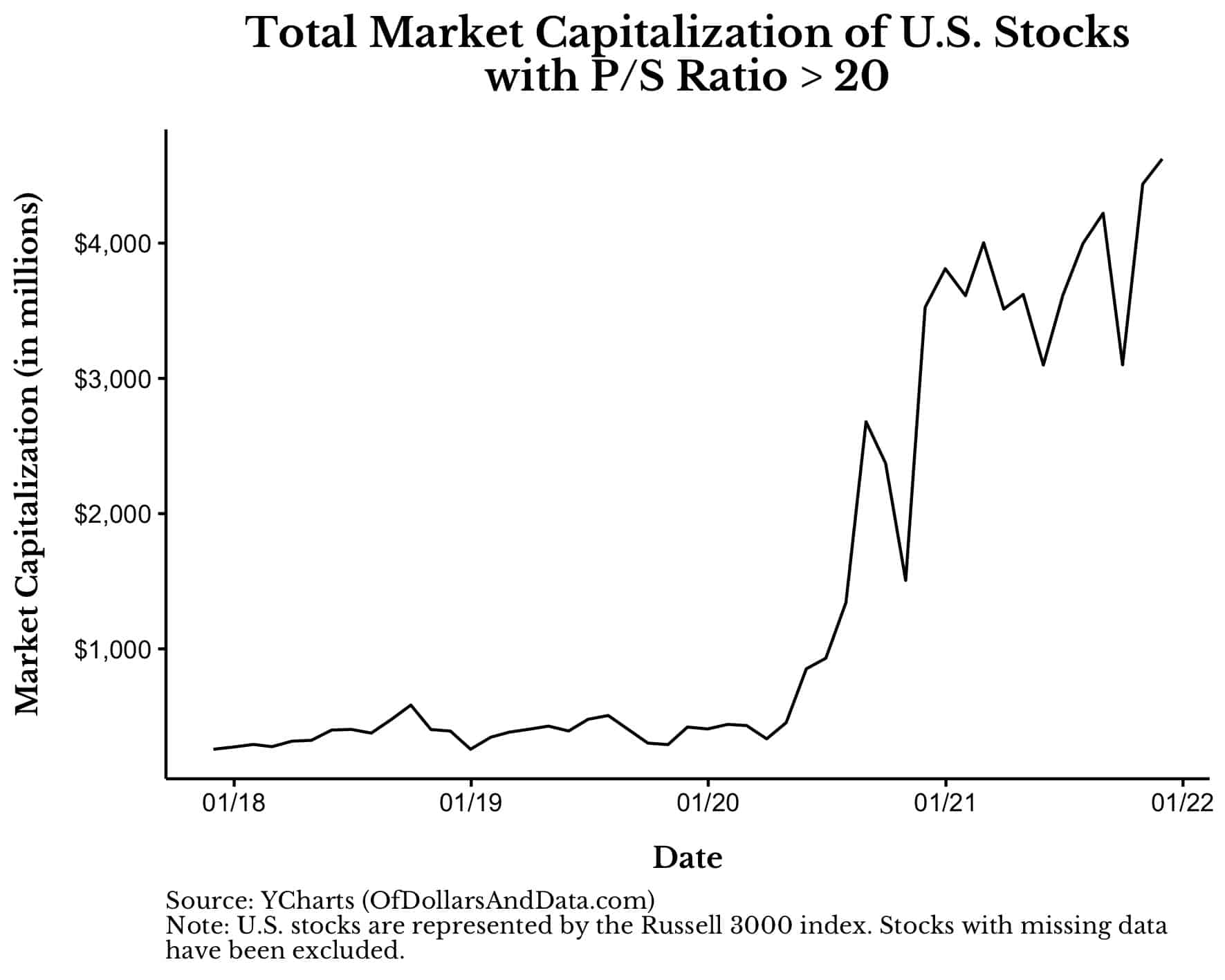

The final time I wrote about common inventory marketplace froth in November 2021 I relied at the P/S ratio. That is what it appeared like on the time:

Inside a couple of months of that publish, many of those top P/S shares had been crashing. If we had been to re-run this chart thru lately, it might glance one thing like this:

Word that the massive spike in early 2022 befell after I revealed my “This Will Now not Ultimate” caution in November 2021. Even whilst you know one thing is off, getting the timing proper is extremely tough.

Both approach, you’ll be able to see that there are some frothy parallels between now and 2021. It’s now not simply me who has pointed this out both. Apollo World Control created this chart illustrating that the 12-month ahead P/E ratio of the highest 10 corporations within the S&P 500 is upper lately than it was once all the way through the DotCom bubble:

I don’t need to draw too many comparisons to the DotCom bubble as a result of this turns out somewhat other. Regardless that valuations as an entire are quite increased, this publish isn’t supposed to be a “This Will Now not Ultimate” Section II. If there may be any marketplace frothiness lately, that frothiness is extremely concentrated.

For instance, within the chart above appearing the marketplace capitalization of businesses with a P/S ratio > 20, just about 66% of that marketplace capitalization lately is one corporate—Nvidia. That wasn’t true in 2021. Sure, there was once indisputably focus within the tech sector, however now not like this.

So, when you personal a number of Nvidia inventory, I will be able to say the similar factor that I stated to Tesla shareholders again in early 2021—simply take the cash. You’ve gained the sport. You’ve hit a lotto that you’re not likely to hit once more. Take no less than some of your features and diversify. Cross on holiday. Revel in existence.

Don’t get me fallacious, when you concentrate to me you’re more likely to feel sorry about it within the coming months. Alternatively, I doubt you’ll feel sorry about it within the coming years.

The ones Tesla shareholders that heeded my caution on January 12, 2021 and offered their stocks would’ve neglected out on a forty five% acquire thru November 2021. Alternatively, those self same traders additionally wouldn’t be down 27% on their Tesla stocks thru lately both.

Somebody who circled out of Tesla and into the S&P 500 on January 12 2021, can be up 55% as a substitute:

In fact, perhaps this time is other. Perhaps Nvidia’s close to monopoly gained’t be challenged through regulators. Perhaps the efforts of competition to increase their very own chips will all fail. Perhaps the tech giants can be satisfied to stay sending 10%+ in their capital expenditures to Nvidia indefinitely. However, I doubt it.

Now not best does Nvidia must handle its personal demanding situations from competition and regulators, however with the shortcomings of AI itself. Sure, the AI/LLM revolution is actual, however there’s nonetheless so much to be desired. It strikes a chord in my memory of this quote I learn from an nameless Twitter person about AI:

“if my canine may summarize the newspaper to me each and every morning however were given 20% of the tales fallacious i’d be enthusiastic about the canine however would nonetheless learn the newspaper the traditional approach.”

For the report, I’m a large fan of LLMs. I wouldn’t had been in a position to construct my S&P 500 ancient go back calculator with out them. Alternatively, like several generation, they have got critical barriers. Simply believe this easy instance (and why it occurs):

That’s going to take over the sector?

In all seriousness, I convey up the issues with AI on account of how they may have an effect on Nvidia downstream. If the call for for AI declines, so will the call for for Nvidia’s GPUs. Whilst this turns out not likely at this time, the longer term is at all times unsure.

With that being stated, I don’t know what Nvidia’s inventory will do over the following month, the following 12 months, or the following decade. I don’t know so much about AI or GPUs and I don’t declare to. However I know marketplace historical past. And the previous couple of occasions the information advised me what it’s telling me now, it didn’t finish neatly for the ones traders.

Don’t business maybes for certainties. They’re hardly ever definitely worth the chance.

Thanks for studying.

In the event you appreciated this publish, believe signing up for my e-newsletter.

That is publish 414. Any code I’ve associated with this publish may also be discovered right here with the similar numbering: https://github.com/nmaggiulli/of-dollars-and-data