It’s time to take a seat again, calm down and experience somewhat joe …

It’s time to take a seat again, calm down and experience somewhat joe …

Welcome to any other rousing version of Black Espresso, your off-beat weekly round-up of what’s been happening on this planet of cash and private finance.

I am hoping everyone had a stupendous week. And with that, let’s get proper to this week’s statement, we could?

The selection is between trusting to the herbal balance of gold and the honesty and intelligence of Executive. And, with due appreciate for those gents, I counsel you, so long as the capitalist device lasts, to vote for gold.

– George Bernard Shaw

Credit and Debits

Credit score: Did you spot this? Males are paying off their pupil loans a long way faster than girls, who’re taking greater than a decade to retire their debt, whilst seeing little or no decline of their remarkable loans. For individuals who are questioning why, the most straightforward clarification is each and every sexes’ major selection of faculty primary. In accordance to a couple, the perfect paying majors are ruled via males, whilst the bottom paying are ruled via girls. Is sensible. Oh, yeah … for many who are questioning, right here’s any other perplexing query. Fortunately, social media stored the day as any individual was once sort sufficient to offer a solution:

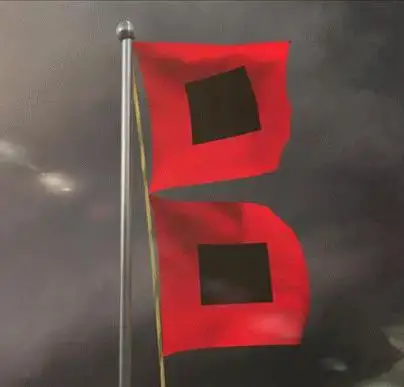

Debit: Then there’s this: Do you know Nice Britain’s electrical energy expenses are a few of the perfect on this planet? They’re. In reality, Brits pay 5 instances extra for his or her electrical energy than the Chinese language, and two times up to American citizens. Probably the most largest causes: sun corporate subsidies designed to stay those economically unviable sun farms in industry. Good day … I’m now not sayin’. I’m simply sayin’. That being stated, there are those that proceed to insist that it received’t be lengthy till the fairway power revolution starts rocketing skyward. Or now not …

Debit: In the meantime, again in this facet of the pond … a brand new find out about of a couple of metropolitan US housing markets has discovered that, in additional than one-third of the houses in the ones markets, house owners have been spending a minimum of 43% in their wages on housing. That stage is regarded as to be “significantly unaffordable” via the find out about’s authors. Good day … it’s difficult far and wide, other people. Whether or not we love it or now not …

Debit: On a similar observe, house evictions in the USA are up greater than 15% in comparison to the length earlier than the pandemic, as American citizens proceed to combat with emerging costs. Alternatively, the issue is noticeably worse in Houston, Minneapolis-St. Paul, Las Vegas, and Gainesville, the place the eviction price is a minimum of 40% upper than it was once earlier than the pandemic began. It makes us marvel what’s flawed with this image. And this one …

Debit: Talking of inflation … the standard family is now spending $925 extra a month to buy the similar items and services and products than they did in the summertime of 2021. Take into account that, we’re lovely positive that any one who buys groceries, fills their automobile tank with gas, buys insurance coverage, rents their house, can pay for utilities – or stores at Buck Tree – already knew that.

Debit: Take into account that, it shouldn’t be a marvel to any person {that a} new survey of 80,000 small companies in the USA discovered that almost part of them warn that they is not going to live on “the present financial local weather or ongoing inflation.” On the other hand, huge companies like Tesla are lately coping with their very own problems …

Credit score: Ultimate week, Russian Overseas Minister Sergey Lavrov as soon as once more reiterated that the method of de-dollarization can’t be stopped, as many countries at the moment are on the lookout for an alternative choice to the USA greenback (USD) as a way to stay their long-term financial savings safe. Unfortunately, many other people shills are making a bet at the flawed horse …

Debit: Certainly, whilst whilst foreigners proceed to buy US Treasuries, the share of foreigners who personal American executive bonds continues to fall. In reality, a decade in the past foreigners owned part of all US Treasuries; these days they cling simply 30% of US marketable debt. That is simply extra proof that – in the case of fiat currencies – the sector is turning into increasingly more upset with the usage of the USD as its long-term retailer of price just because it’s the cleanest grimy blouse within the laundry. Anyone go the cleaning soap …

Credit score: Conversely, in keeping with Sprott, “central financial institution gold purchases persevered at an increased stage for the primary quarter of 2024 with 289 tonnes, bringing the trailing seven-quarter reasonable to 309 tonnes vs. the prior decade’s quarterly reasonable of 126 tonnes, or 2.4-fold building up.” Take into account that, they’re purchasing the yellow steel to give protection to their fiscal steadiness sheets; it’s simply unlucky that most people sees no want to do the similar. In any case, keeping somewhat bodily gold is a a long way higher approach to give protection to your buying energy than doing this:

Debit: On a similar observe, we see that Investopedia printed a brand new article remaining week on what would purpose a possible USD cave in – and the way it might play out. It wasn’t too way back the one puts you’d see articles like this was once on tin foil hat blogs like this one. Now “greenback cave in” tales are bobbing up in all places. Consider that.

Credit score: We’ll shut this week with macro analyst Invoice Holter, who’s predicting that, “an excellent trade in ‘world forex’ is set to happen” and due to this fact you should personal valuable metals earlier than it occurs. As Holter explains, at that time, “You’ll both be in, or you’ll be out, most probably for the rest of your monetary lifestyles.” He’s proper, you understand. Unfortunately, those that might be at the out of doors taking a look in received’t understand their mistake till it’s too overdue.

Via the Numbers

American citizens are projected to extend their collective bank card debt via $120 billion this yr, and the grand general at just about $1.3 trillion. With that during thoughts, a brand new find out about has made up our minds the states the place shoppers take the longest to repay bank card debt. Listed below are the 5 states with the longest – and shortest – payoff instances:

50 West Virginia (shortest payoff time)

49 Pennsylvania

48 Nebraska

47 South Dakota

46 Utah

5 Oregon

4 New Mexico

3 Colorado

2 Vermont

1 Alaska (longest payoff time)

Supply: Pockets Hub

The Query of the Week

Do you propose on gazing the 2024 summer season Olympics?

- No (80%)

- Sure; however simplest once in a while (15%)

- Sure; incessantly (5%)

General Citizens: 859

Ultimate Week’s Ballot Effects

Do you may have a bumper sticky label on any of your vehicles?

Greater than 1800 Len Penzo dot Com readers replied to remaining week’s query and it seems that simply 1 in 20 of you may have a bumper sticky label on any of your vehicles. Now not unexpected … they appear to be much less widespread than they was once. Why do you assume this is?

If you have a query you’d like to peer featured right here, please ship it to me at Len@LenPenzo.com and be sure you put “Query of the Week” within the matter line.

Needless Information: Magic Tips

Hillary Clinton and Donald Trump cross right into a bakery.

Once they input the bakery, Hillary steals 3 pastries and places them in her pocket.

She says to Donald, “See how artful I’m? The landlord didn’t see the rest and I don’t even want to lie.” I will be able to no doubt win the election.

The Donald says to Hillary, “That’s the standard dishonesty you may have displayed all the way through your whole lifestyles, trickery and deceit. I’m going to turn you a good strategy to get the similar consequence.”

Donald is going to the landlord of the bakery and says, “Give me a pastry and I will be able to display you a magic trick.” Intrigued, the landlord accepts and provides him a pastry. Trump swallows it and asks for any other one. The landlord provides him any other one. Then Donald asks for a 3rd pastry and eats that, too.

The landlord is beginning to marvel the place the magic trick is and asks, “What did you do with the pastries?” Trump replies, “Glance in Hillary’s pocket”

(h/t: Simply the Details by way of 0 Hedge)

Purchase Me a Espresso? Thank You So A lot!

For the most productive studying revel in, I provide all of my contemporary Black Espresso posts with out commercials. For those who loved this week’s column, purchase me a espresso! (Dunkin’ Donuts; now not Starbucks.) Thanks such a lot!

.

Extra Needless Information

Listed below are the highest 5 articles seen via my 49,024 RSS feed, weekly e-mail subscribers, and different fans during the last 30 days (apart from Black Espresso posts):

- Is Silver Undervalued? The Proof Is Overwhelming

- What Are the Maximum Commonplace Birthdays?

- A Take a look at the Advantages of Italian DIY Citizenship

- 20 Simple Tactics to Save $5 a Day

- This Blue Fruit Cuts $400 Off My Grocery Invoice Each and every Yr

Good day, whilst you’re right here, please don’t put out of your mind to:

1. Subscribe to my weekly Len Penzo dot Com E-newsletter! (It’s simple! See the large inexperienced field within the sidebar on the most sensible of the web page.)

2. You should definitely apply me on my new favourite quick-chat web page, Gab! After all, you’ll at all times apply me on Twitter. Simply watch out what you are saying there.

3. Turn out to be partial to Len Penzo dot Com on Fb too!

And remaining, however now not least …

4. Please toughen this site via patronizing my sponsors!

Thanks!!!! 😊

Letters, I Get Letters

Each and every week I function probably the most attention-grabbing query or remark — assuming I am getting one, this is. And other people who’re fortunate sufficient to have the one query within the mailbag get their letter highlighted right here whether or not it’s attention-grabbing or now not! You’ll succeed in me at: Len@LenPenzo.com

After studying a up to date Len Penzo dot Com article providing guidelines that will help you toughen your credit score ranking, James Rosa left this remark:

I understand how it feels to be annoyed via credit score record problems. I paid a credit score hacker however it didn’t figure out for me. Then I made up our minds to mend my very own credit score the old school approach — principally via paying my expenses on time.

Just right for you, James! Not like that so-called “credit score hacker,” you’ll make sure that self-reliance and private accountability won’t ever assist you to down.

For those who loved this, please ahead it on your family and friends. 😊

I’m Len Penzo and I licensed this message.

Picture Credit score: public area