Supply: The School Investor

When evaluating 529 plans, you want to each take a look at efficiency and costs.

Two researchers on the College of Kansas Faculty of Trade have recognized issues in how some states arrange their 529 faculty financial savings plans. They counsel that those issues are brought about by way of conflicts of hobby, insufficient oversight, and a loss of funding sophistication by way of the state sponsors.

Consistent with the School Financial savings Plan Community, a general of $508 billion is invested in 16.8 million 529 faculty financial savings plans as of June 30, 2024.

The result’s that customers who use 529 plans in positive states might be paying extra charges (because of those conflicts of hobby), which decrease their funding returns through the years. If in a position to choose, shoppers will have to go for the bottom plan charges imaginable to maximise returns.

You’ll to find your state’s plan and notice the costs in our 529 Plan Information By means of State.

Traits of 529 Plan Charges

Justin Balthrop and Gjergji Cici of the College of Kansas analyzed 5,339 distinctive funding choices throughout 86 state 529 faculty financial savings plans for his or her paper, Conflicting Incentives within the Control of 529 Plans.

Two-thirds of the 529 plans are direct-sold and one-third are advisor-sold. Handiest 10% of the plans are controlled in-house, with the remaining outsourced to exterior program managers. A 3rd have revenue-sharing agreements with the underlying mutual budget.

About part of the full charges from 529 plans pass to the state, this system managers, and quite a lot of intermediaries.

The executive asset-based charges for 529 plans are 5 occasions better than the equivalent charges for managing a retirement plan.

The moderate 529 plan charges come with the next:

- State Charges: 0.04%, however may also be as prime as 0.26%

- Program Supervisor Charges: 0.16%, however may also be as prime as 1.15%

- Distribution Charges: 0.23%, however may also be as prime as 1.10%

- Underlying Fund Charges: 0.38%, however may also be as prime as 1.29%

The entire expense ratio – the sum of all asset-based charges – averages 0.81% with a typical deviation of 0.53%. The expense ratio may also be as prime as 2.49%.

For the reason that the typical go back on funding for a 529 plan is ready 6% in keeping with ancient efficiency information, some states and program managers are extracting a good portion of investor returns for their very own receive advantages.

In some instances, households could be at an advantage saving in taxable accounts.

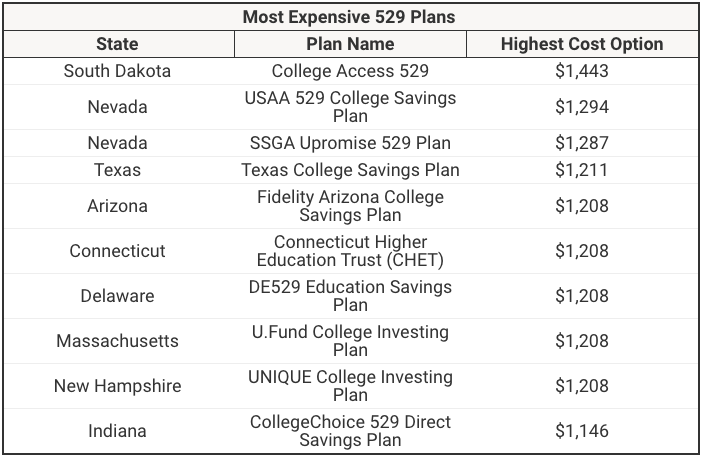

States With The Best possible 529 Plan Charges

Consistent with the newest Saving For School 529 Plan Price Learn about, listed below are the states with the very best charges. This learn about seems on the 10-years prices of a $10,000 funding for direct-sold plans. You must observe that advisor-sold plans may have a lot greater charges.

Evaluating the costliest plan technique to the least pricey possibility, South Dakota School Get entry to 529 fees over 10x the costs of the Lousiana START Financial savings Program.

The ten most costly 529 plans in the USA all price virtually 3x the of charges of the ten least pricey plans in the USA.

Listed below are the ten most costly 529 plans in the USA (take into account, every state can, and usually does, have a couple of plan choices):

Research of the costliest 529 plans by way of state. Supply: The School Investor

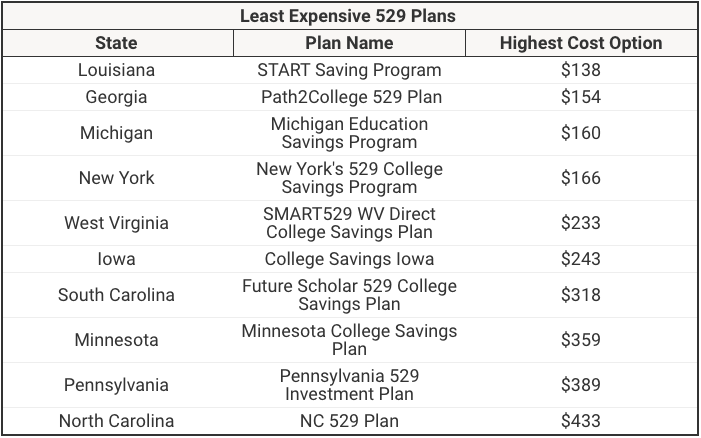

You’ll examine the above states and plans with the choices beneath. We are highlighting the HIGHEST charge possibility within the state. Louisiana does be offering a plan with $0 prices, which is a hard and fast source of revenue plan controlled without delay by way of the state treasurer, however this plan is handiest open to in-state citizens.

Research of the least pricey 529 plans by way of state. Supply: The School Investor

Tradeoff between State Earnings and Program High quality

Some states price greater charges than different states, however this usually does no longer yield an development in program high quality. Actually, moderately the other.

The 529 plans in states that extract extra profit from the 529 plans be offering extra restricted funding choices that price greater charges and supply inferior internet efficiency. The rise within the underlying fund charges is ready 1 / 4 of moderate mutual fund charges.

The upper-cost 529 plans be offering fewer funding choices and are much less most probably to provide low cost index budget. Those states additionally don’t supply further or higher state source of revenue tax breaks.

The College of Kansas researchers discovered that funding choices from plans the place states extract essentially the most profit have a median underlying fund expense ratio of 0.506%, whilst funding choices from states that extract the least profit have a median underlying expense ratio of 0.219%. Thus, when a state extracts extra profit from the state’s 529 plan, the expense ratio is greater than two times as prime (2.3x greater).

The College of Kansas researchers extensively utilized Sharpe Ratios calculated by way of Morningstar for all of the 529 plans, appearing that buyers in those higher-cost 529 plans enjoy worse efficiency.

A Sharpe Ratio is a risk-adjusted go back on funding. It’s the 529 plan’s go back on funding minus the risk-free price of go back and divided by way of the usual deviation of the surplus go back. The next Sharpe Ratio is best.

The 529 plans from states that extract extra profit from the 529 plans have a decrease Sharpe Ratio than 529 plans from states that extract much less profit, an indication that the funding plan efficiency, internet of charges, is inferior. The Sharpe Ratios within the 529 plans within the prime revenue-extraction states are 20% less than the Sharpe Ratios within the states that extract the least profit from the 529 plans.

Conflicts of Passion

Since 529 plans generate profit for the states and program managers, there may be doable for conflicts of hobby.

Incentives for the state don’t seem to be essentially aligned with the most efficient pursuits of plan individuals.

States get greater charges in change for offering program managers with extra flexibility to extract extra profit, without delay and not directly, from plan individuals.

529 plans steadily come with funding choices from this system supervisor’s personal mutual budget and from funding corporations with which this system supervisor has revenue-sharing agreements.

529 plans with revenue-share agreements have underlying fund charges and general expense ratios which might be 0.08% and zero.18% greater than different 529 plans.

Some examples the document highlighted had been plans the usage of extra charges to fund different state projects. Or there being a dis-incentive to barter higher charges for buyers since states benefit from the extra revenues. In essentially the most egregious shape, 529 plan charges could also be used to fund promoting campaigns that some critics have known as political campaigning, relatively than investor schooling.

Lax Oversight

There’s little or no efficient oversight over the control of 529 plans.

529 plans are exempt from the Funding Corporate Act of 1940 and Securities Act of 1933. They aren’t required to sign up with the Securities and Trade Fee (SEC), so the SEC isn’t a supply of investor coverage. SEC laws relating to funding disclosure don’t observe to the 529 plans.

529 plans don’t seem to be matter to a fiduciary same old. On the other hand, SEC rules do require funding advisors, corresponding to those who suggest advisor-sold 529 plans, to reveal conflicts of hobby and believe prices when recommending merchandise. The SEC’s Law Easiest Passion (Reg BI) isn’t moderately a fiduciary same old, only a suitability same old. It does no longer observe to the 529 plans themselves, simply the funding advisors.

The states supply some oversight by way of appointing advisory forums. On the other hand, the politically-appointed advisory forums might lack the monetary sophistication had to align the 529 plan with the most efficient pursuits of buyers.

Program managers steadily supply extra price profit to the states that experience weaker oversight.

Insufficient disclosures make it tougher for buyers to make knowledgeable choices. There aren’t any uniform disclosure practices which might be standardized throughout all 529 plans.

States that price greater charges, which impacts the web go back on funding, don’t supply higher advantages for buyers.

The states supply some oversight by way of appointing advisory forums. On the other hand, the politically-appointed advisory forums steadily lack the monetary sophistication had to align the 529 plan with the most efficient pursuits of buyers.

States that price greater charges, which impacts the web , don’t supply higher advantages for buyers.

Program managers steadily supply extra price profit to the states that experience weaker oversight.

Insufficient disclosures make it tougher for buyers to make knowledgeable choices. There aren’t any uniform disclosure practices which might be standardized throughout all 529 plans.

Evaluating 529 Plans: Guidelines for Buyers

Minimizing prices is the important thing to maximizing internet returns.

Upper charges don’t seem to be related to a greater internet efficiency after subtracting the costs from funding returns. The funding choices don’t essentially supply higher returns on funding. Even if they do, the larger returns don’t seem to be sufficient to catch up on the upper charges.

So, buyers will have to make a selection the state 529 plans with the bottom charges.

There’s steadily a tradeoff between low charges in an out-of-state 529 plan and state source of revenue tax breaks for contributions to the state’s personal 529 plan. There’s an inflection level between opting for low charges and state source of revenue tax breaks when the kid enters highschool. Stay the next in thoughts, if opting for a 529 plan someday:

- When the kid is younger, the households will have to focal point on 529 plans that experience decrease charges.

- When the kid enters highschool, new contributions will have to be directed to that state’s 529 plan if the state provides a state source of revenue tax smash on contributions to the state’s 529 plan.

Low charges observe to all of the 529 plan steadiness, whilst the state source of revenue tax smash applies handiest to every yr’s new contributions.

Morningstar.com and Savingforcollege.com supply rankings of 529 plans that believe the web go back on funding after subtracting the costs. Savingforcollege.com additionally publishes a that evaluates the affect of the variability of charges fees by way of every direct-sold 529 plan’s funding choices.

For a greater figuring out of contributing to a 529 plan for your state and what charges are concerned, take a look at our whole 529 information.