It’s time to take a seat again, loosen up and revel in just a little joe …

It’s time to take a seat again, loosen up and revel in just a little joe …

Welcome to some other rousing version of Black Espresso, your off-beat weekly round-up of what’s been happening on this planet of cash and private finance.

I am hoping everyone had an stress-free week. With out additional ado, let’s get proper to this week’s observation …

In an the other way up global, with the entire regulations being rewritten as the sport is going on, it’s just right to really feel that some issues appear to stick as they all the time had been.

– Kenneth Extra

The Golden Rule: He who has the gold makes the principles.

– Historic proverb

Credit and Debits

Debit: Did you notice this? Disney CFO Hugh Johnston introduced this week that their theme parks is also in for a coarse patch throughout the following couple of quarters as a result of, “Decrease source of revenue shoppers are … stressed out and shaving just a little bit off their time on the parks, and better source of revenue shoppers are touring in a foreign country.” Alternatively, that’s completely comprehensible when it takes upwards of $500 simply to get a circle of relatives of 4 during the access gate. Yeah, I do know … however no less than Disney shareholders are making out like bandits. Oh, wait …

Debit: On a similar be aware, a contemporary survey discovered that 3 in 4 American citizens say they’re no longer financially safe. The typical American calls for a miles greater source of revenue to are living very easily, the document discovered. These days, the typical full-time employee makes about $79,000, in line with the USA Census Bureau. In the meantime the survey discovered the typical American wishes an source of revenue of $186,000 to are living very easily.

Debit: Through the best way, production jobs are actually decrease than they weren’t handiest throughout the pandemic, but additionally the depths of the Nice Monetary Disaster in 2008. See for your self …

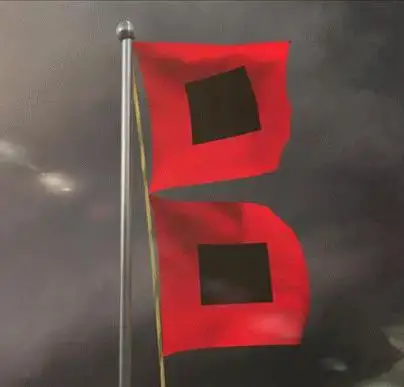

Debit: In the meantime, the newest activity information is out and it’s so unhealthy that it brought on the so-called Sahm Rule. This arguable rule was once cited through the present management to refute the ancient recession definition of 2 consecutive quarterly GDP contractions – which came about within the first two quarters of 2022. Alternatively, sessions of emerging unemployment had been an issue for empires since time immemorial …

Debit: K … so what, precisely, is the Sahm Rule? (But even so being a brand new information level devised through socialist economist Claudia Sahm that permits govt officers to shop for time through denying {that a} recession is in truth underway?) Neatly … the rule of thumb says a recession is going on each time the unemployment fee rises through part a share level from its previous-year low. And that’s what came about; the newest unemployment fee surged 0.6% from the 12 months’s low. That being stated, we’re certain the federal government is operating on but some other definition that can permit it to say the economic system isn’t in a recession.

Debit: Oh, wait … Sahm is already on report announcing that her recession-trigger rule doesn’t practice this time for the reason that unemployment fee is artificially excessive because of an strangely excessive selection of unemployed unlawful immigrants. Perhaps so … however one thing’s undoubtedly no longer proper with the economic system. You’d most likely trust us too, in case you noticed what our neighbor was once grilling finally week’s group block celebration:

Credit score: In step with RBC analyst Janet Mui, a 50-basis-point fee lower is now in play: “Taken along side the upper jobless claims, contraction within the production hiring survey and July’s jobs document, it’s most probably that the Fed will get started reducing rates of interest subsequent month and there may be expectation that it is going to wish to lower extra aggressively than prior to now penciled in.” If true, search for inflation to select again up – and savvy buyers to reignite some other rush into gold.

(h/t: @Peruvian_Bull)

Credit score: As it’s, macro analyst Alasdair Macleod warned this week that, “Deficient profits from most sensible tech shares and rising proof of a faltering US economic system are decreasing the valuation hole between bonds and equities. That is one of the most over the top relative overvaluation of equities in US monetary historical past. Even more than throughout the dot-com bubble, following which the S&P halved.” Yep. So stay a detailed eye for your portfolio over the approaching days and weeks. Or else …

Debit: Inventory markets in the USA had been down this week with many of the harm being finished on Monday – the excellent news is late-stage good points within the main indices on Tuesday and Thursday in large part wiped away all of Monday’s heavy losses and ended the week handiest down about 1%. That being stated, please don’t ask us for any scorching tips about the most productive inventory marketplace bargains available in the market. However, right here’s a scorching tip you’ll use out of doors the markets …

Credit score: Mythical marketplace commentator Jim Grant: “The breakdown of American fiscal self-discipline and the explosion of the USA public debt didn’t happen throughout the primary quarter century of the Bretton Woods gadget,” when the USD was once in truth anchored to gold. That’s as a result of that anchor to the yellow steel acted as a de facto credit score prohibit on Congress, which in flip compelled The usa’s politicians to tone down their urge for food for spending. Keep in mind that, everyone knows how that became out …

Credit score: This all has let Mr. Grant to proclaim that, “The sextant sailed us around the globe and the slide rule were given us as much as the moon, however neither beats your pocket-sized GPS-cum-high-speed-computer. Even so, I stand with anachronism. I just like the low hum of cultured voices, nice books, and the useless authors who wrote them. I consider within the fedora hat, which will have to be tipped within the outdoors and doffed in an elevator. And I give a boost to the gold usual.” As can we, Jim. As can we.

Through the Numbers

A contemporary information research of the 100 biggest US towns published the place bank card, auto mortgage, and private mortgage debt greater probably the most from Q1 2024 to Q2 2024. Listed below are the ten American towns the place individuals are including probably the most debt to their steadiness sheets:

10 Los Angeles, CA

9 Albuquerque, NM

8 Aurora, CO

7 Greensboro, NC

6 St. Louis, MO

5 Gilbert, AZ

4 Lubbock, TX

3 Madison, WI

2 North Las Vegas, NV

1 Boston, MA

Supply: Pockets Hub

The Query of the Week

What’s the minimal annual source of revenue you wish to have to be really glad?

- $75,000 (49%)

- $100,000 (29%)

- $150,000 (14%)

- $50,000 or much less (7%)

- $200,000 or extra (1%)

Overall Electorate: 772

Final Week’s Ballot Consequence

Which continents have you ever been to?

- North The usa (83%)

- Europe (7%)

- Asia (4%)

- Australia (3%)

- South The usa (2%)

- Africa (1%)

Greater than 1800 Len Penzo dot Com readers replied final week’s query and it seems that, excluding North The usa, extra readers have stepped at the Eu continent than another.

If you have a query you’d like to invite the readers right here, ship it to me at Len@LenPenzo.com and you’ll want to put “Query of the Week” within the topic line.

Pointless Information: Excellent Query

Rising up as a child, I discovered all about capitalism during the board sport Monopoly. I imply, what higher option to educate a tender thoughts about how our economic system purposes. I cherished this sport as a child — and nonetheless do! Best now, as an grownup I’ve some questions that stay unanswered. As an example, if I’ve all this cash and personal all this actual property, then why am I nonetheless using round in a thimble?

(h/t: Cowpoke)

Purchase me a espresso? Thanks such a lot!

For the most productive studying enjoy, I provide all of my contemporary Black Espresso posts with out commercials. If you happen to loved this week’s column, purchase me a espresso! (Dunkin’ Donuts; no longer Starbucks.) Thanks such a lot!

.

Extra Pointless Information

Listed below are the highest — and backside — 5 states in relation to the typical selection of pages considered in line with talk over with right here at Len Penzo dot Com during the last 30 days:

1. Kentucky (2.51 pages/talk over with)

2. Montana (2.50)

3. Maine (2.39)

4. Nebraska (2.26)

5. Connecticut (2.24)

46. Nevada (1.45)

47. Iowa (1.43)

48. Oregon (1.42)

49. Virginia (1.35)

50. North Carolina (1.29)

Whether or not you occur to revel in what you’re studying (like my pals in Kentucky) — or no longer (ahem, North Carolina …) — please don’t omit to:

1. Subscribe to my weekly Len Penzo dot Com Publication! (It’s simple! See the large inexperienced field within the sidebar on the most sensible of the web page.)

2. Make sure to practice me on my new favourite quick-chat web page, Gab! In fact, you’ll all the time practice me on Twitter. Simply watch out what you are saying there.

3. Change into keen on Len Penzo dot Com on Fb too!

And final, however no longer least …

4. Please give a boost to this site through trying out my sponsors’ commercials!

Thanks!!!! 😊

Letters, I Get Letters

Each and every week I characteristic probably the most fascinating query or remark — assuming I am getting one, this is. And other people who’re fortunate sufficient to have the one query within the mailbag get their letter highlighted right here whether or not it’s fascinating or no longer! You’ll succeed in out to me at: Len@LenPenzo.com

After studying a contemporary article right here on find out how to get ready your youngsters for the true global, Roger left this be aware:

Except we’re discussing a cheap loan to buy a house, I’m instructing my youngsters to keep away from debt in any respect prices (pun meant).

Simple there, Roger … I’m the man who is meant to do the entire jokes round right here.

If you happen to loved this version of Black Espresso and located it to be informative, please ahead it for your family and friends. Thanks! 😀

I’m Len Penzo and I authorized this message.